[UPDATED, 2021]

Pay Private Mortgage Insurance (PMI) or play the wait-and-save game? That’s the dilemma for a majority of would-be homebuyers. It’s rarely an easy (or fun) choice.

The Dilemma

Coming up with a 20% down payment can take years. With home prices increasing 5-10% annually, the home of your dreams is sure to cost quite a bit more in 2026. Rather than save, some homebuyers opt to pay PMI instead. Most future homeowners don’t know what PMI is and how much it may cost them.

What’s the Purpose of PMI?

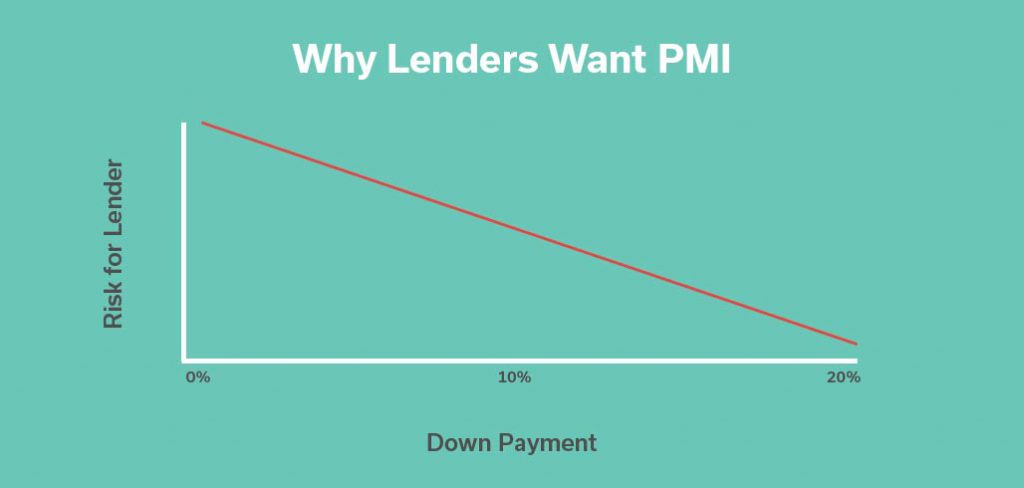

Usually you purchase insurance to protect yourself. PMI works differently: basically you pay to protect the mortgage lender in the event you can’t pay the mortgage. It’s basically a mortgage lender’s insurance to protect themselves if a borrower stops making payments.

In general, mortgage lenders consider buyers who put at least 20% down to have enough skin in the game that they’re low risk. That makes everyone that puts down less than 20% a riskier investment, so they require them to pay PMI.

The Upside of PMI

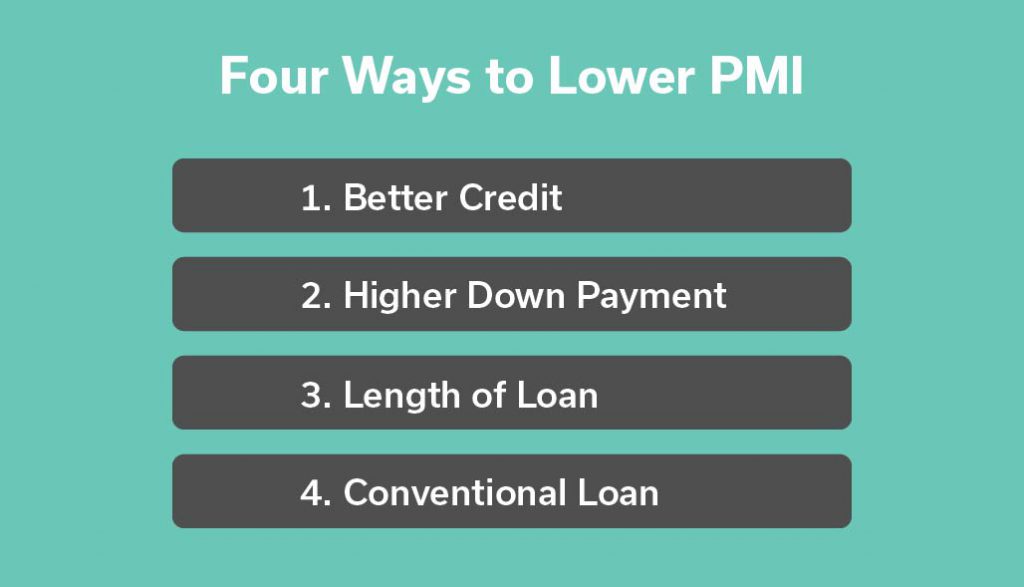

The good news about PMI is that it’s not too expensive and you don’t pay it forever. Your lender typically requires you to pay PMI until you get to a Loan-to-Value (LTV) ratio of 80% loan to 20% equity. Once you do, you can request your PMI be cancelled, unless you’ve taken out a FHA loan (PMI never falls off when you choose this loan type). PMI also doesn’t cost too much, although the amount you pay can vary. Below are a few ways to lower your payment.

Commonly Asked PMI Questions

How much will I pay in PMI?

Homebuyers required to pay PMI typically pay around 0.5% annually of the total amount borrowed, with the cost split across all 12 months. Here’s some examples:

- $180,000 loan ($200,000 with 10% down), PMI $75/mo

- $285,000 loan ($300,000 loan with 5% down), PMI $125/mo

When will I be done paying PMI?

This depends on what type of loan you take out. Here’s a quick guide:

- FHA: If you take out an FHA loan, mortgage insurance continues for the life of the loan. Ouch. You’d have to refinance your loan to get rid of it.

- Conventional: On a conventional loan you only pay PMI until your equity reaches 20%.

How can I avoid paying PMI entirely?

Your house is probably your biggest expense, and the thought of spending extra money each month is as appealing as week-old sushi. Do you have to pay PMI? No, not if you do any of the following:

- Put 20% down. Call the parents, check in with Grandma, collect every debt from your former roommates. When you put 20% down, you don’t pay PMI at all.

- Opt for an 80-20 piggyback loan. 80-20 mortgage is paid through two loans, a first and a second mortgage. The 80 first mortgage covers the home loan; the 20 second mortgage is the down payment. The second loan in a piggyback loan usually has a higher interest rate.

- Look for owner financing. In some situations, owner financing works like rent-to-own, in which case you probably won’t be required to pay 20% down or PMI.

- Shop for homes at a lower price point. Consider the difference in down payment for a $250,000 home versus a $300,000 home: (we’ll save you the math: it’s $10,000). Lower price homes may fit your savings account better—and you can trade up or add on later.

- Check out Homie Loans™. Homie Loans™ can look at your personal financial situation and tell how you can lower your PMI. Homie Loans™ may be able to help you with a new loan.

To Pay or Not to Pay? The Decision is Yours

No one wants to pay extra each month for their home, but if paying PMI means you can buy a $300,000 home now vs. waiting five years while you save, paying a few thousand in PMI over that same period can make a lot of financial sense. Plus, the $300,000 home you purchase now starts building equity ASAP and will likely increase in value each year you live there.

We’re Here to Help

There’s a lot to consider when choosing to pay PMI vs. wait and save for a 20% down payment, but we hope we’ve given some helpful tips to guide you in the right direction. If you have any additional questions, or would like to begin the home buying process, click here to learn more about how to get started. We’d be happy to help you start your search for your dream home!