The Federal Reserve has only raised interest rates twice in the past 10 years, but they’ve forecast three quarter-point rate bumps in 2017… and Janet Yellen just confirmed that the first hike will happen in March (predicted March 15th). What does this mean for first-time home buyers? For many, it’s the difference between being able to buy their first home vs. extending their stay in their parents’ basement.

What to watch

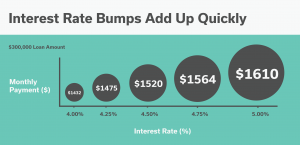

Interest rates inch up. Higher interest rates increase your cost for, well, everything. Your credit cards, your car loan, and, in time, your home loan.

Rents will rise. When interest rates increase, rates for commercial loans also increase, which means builders have to pay more. Who do they to pass the price hike to? Yep, renters.

Home prices will rise. Increasing interest rates are a sign of a healthy economy, which can lead to even higher home prices.

What more Millennial buyers means

October 2016, Zillow released a study indicating that the number of first-time buyers under 30 was 47%. This figure is much higher than the previous NAR study (a mail-based format vs. Zillow’s online format), which put the number at 32%. Given that most Millennials are more likely to respond to an online survey than a snail-mail survey, Zillow’s numbers are likely to be more accurate. The impact for the Millennials who want to buy their first home is two-fold:

- You’ve got more buyers competing for the same houses

- First-time buyers don’t have a home to sell, bringing the available inventory down more, which tends to raise sale prices

What to do

Stop saving. It seems counter-intuitive, but if you’re waiting to buy a home until you can save more for your down payment, you might want to reconsider. Any reduction you might qualify for by having a higher down payment could be nullified by coming the rate hike. Loan programs exist for as much as 100% of the loan-to-value. It pays to talk to mortgage broker to understand all the variables in your situation and see what makes the most sense.

Improve your credit score. Regardless of how much money you’ve saved for a down-payment, one for-sure way to lower your interest rate is by improving your credit score. Think you don’t have enough time? You can boost that score by 30-100 points using these two tips in less than 10 days.