According to a recent CoreLogic report, the average American homeowner gained over $55K in equity in 2021. Homeownership is one of the best ways to build generational wealth. In fact, homeowners have a median net worth 40 times that of renters.

The homeownership process can be intimidating for many, but the long-term benefits can set you up for long-term financial success. The hardest part is getting started and the best time is now. Median home prices continue to rise and interest rates are currently above 5% and projected to rise even higher later this year.

At Homie, our goal is to make homeownership easy and accessible for all. We’ve broken down how you can get started building wealth through real estate.

Waiting to Buy May Cost You

Because of inflation, everything is more expensive these days, including mortgage loans. For the first time since the 2008 financial crisis, average mortgage rates are higher than 5%. The Fed is expected to continue raising rates the rest of the year to help balance inflation, recently announcing six additional rate hikes in the near future. While slight percentage point increases don’t seem like a lot, it adds up significantly when buying a home.

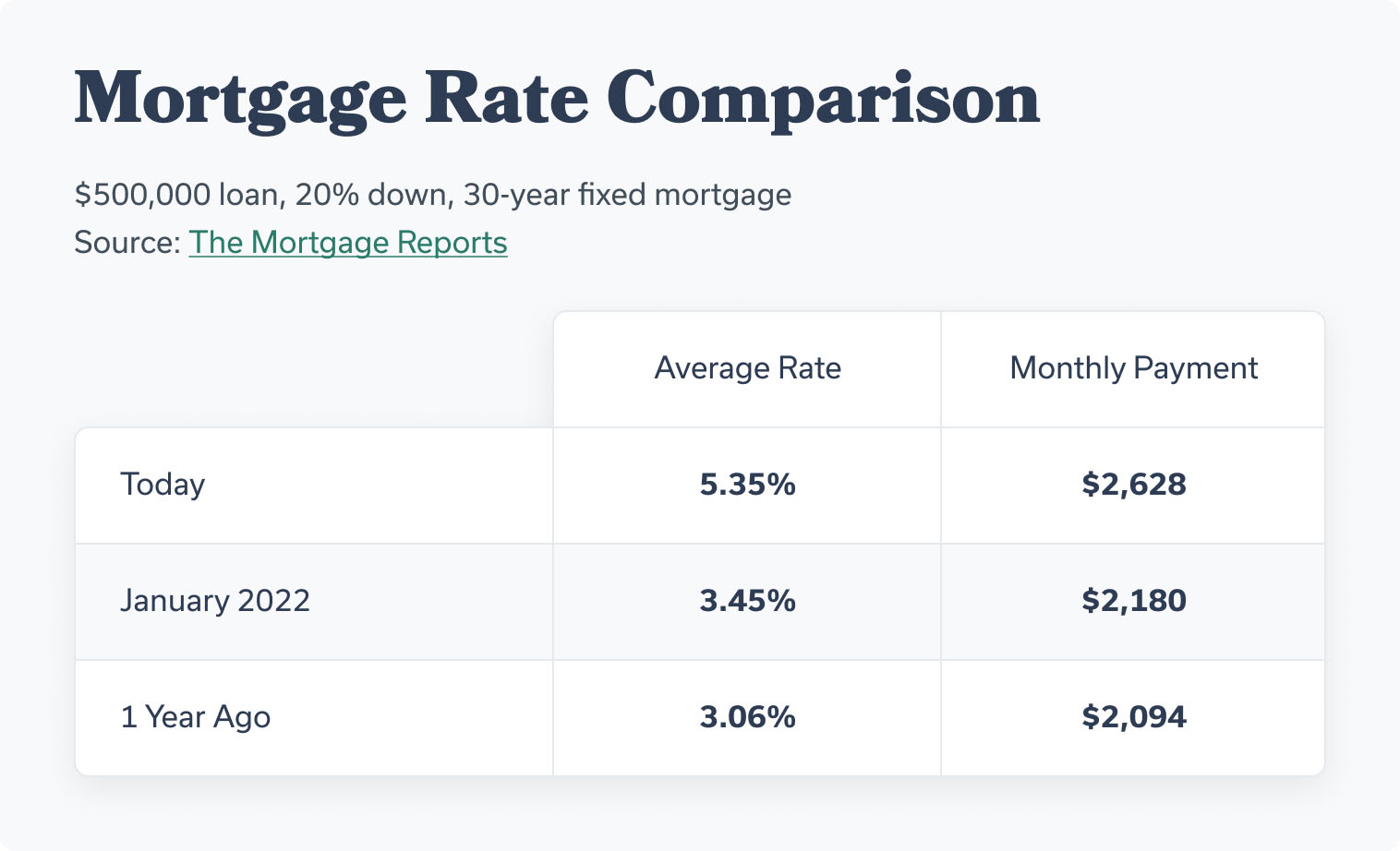

If you’re thinking about buying, now is the time. Waiting may cost you more in the long run. Interest rates have already gone up 1.5% this year, taking buyer power away from consumers. For example, here’s what your monthly payment would look like if you bought a new home now versus in January or last year:

As you can see, every little increase in mortgage rates makes a difference. If you were to buy a $500K home now, you’d pay $448 more a month than you would three months ago. That adds up significantly over time. If you can afford to buy, consider doing it now before rates increase even more.

Getting Started

At Homie, we’ve got your back. We’ve broken down the steps to help you get started on your journey to building wealth through real estate.

- Find Out How Much You Can Afford

Determine how much house you can afford and get pre-approved. A few things to consider are debt to income, monthly expenses, savings, credit score, and monthly income. There are also fees such as HOA dues, insurance, property taxes, and closing costs that are important to factor in. - Get Pre-Approved

Getting pre-approved is a crucial step in the home buying process and gives you peace of mind knowing how much you can afford. A few benefits of getting pre-approved are you know exactly what you can afford, you can make a stronger offer by already being qualified, and fewer delays in the process. Our Homie Loans™ team makes it easy to get pre-approved! A Homie Loans officer can help you get started and find you the best rate. - Create a Wants. Vs. Needs List

It’s important to be realistic about what you can afford and make a list of non-negotiables vs. nice-to-haves. Creating a must-have list will save you both time and money while shopping around and help determine what you’re not willing to compromise on. - Keep Your Credit in Check

Lenders will pull multiple credit reports during the home buying process, so it’s important to make sure nothing with your finances changes throughout the process. Do NOT open any new loans or credit card accounts, close any accounts, or make any big purchases during this time. This can impact your credit score and hinder you from purchasing the home - Find a Trusted Real Estate Expert

Working with a knowledgeable and experienced agent who understands your market and its current conditions can make all the difference in your home buying journey. Homie’s knowledgeable and experienced agents can help you get started in the home buying process.

Benefits of Homeownership

There are several benefits to owning a home. It’s a great start to begin building wealth. In today’s market, homeowners can take advantage of home price appreciation and their rising equity. When you have equity in your home, it can be used to pay down high-interest debt, fund home renovation projects and more. Another way to tap into your home’s equity is when you decide to sell it. In today’s seller’s market, sellers are walking away with a profit that could possibly pay for their new home’s down payment and still have some money left over.

Once you become a homeowner, you have the option to refinance your home. When refinancing, a cash-out refinance can pull money out of your home and even lower your monthly payment with a new, lower interest rate. With interest rates on the rise, this may not be an option right now. However, it’s worthwhile to consider refinancing if rates drop, even if it’s only by 0.75 to 1 percentage point.

The path to homeownership may not always be an easy one but will be worth it in the end. Ready to get started building wealth through real estate? Talk to an agent and begin the home-buying process today.