Original Publish Date: March 31, 2021

If you’re a middle-class American and homeowner, chances are, about two-thirds of your wealth is in your home equity. Homeownership has long been a simple and effective way for Americans to improve their financial standing and build a stable future for themselves and their families.

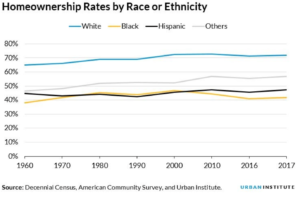

Sounds great, right? Buy a home, grow your wealth. The only problem is the path to homeownership for Black Americans has been a lot more complicated than that. Across America, Black families are much less likely to own their own home compared to White families and other races. Since homeownership is the key to wealth, the Black homeownership gap is directly tied to the nation’s Black wealth gap. Unfortunately, the gap has continued to widen in recent years.

Closing The Black Homeownership Gap

When Homie learned about the gap and its history, we knew something had to be done. Homie’s mission after all is to make homeownership simple, accessible, and affordable for all. Yet for Black Americans homeownership has not been simple, accessible, or made affordable for generations.

In an effort to close the gap and live up to our mission, Homie has joined forces with leaders across Southern Nevada to create the Las Vegas Coalition to Make Homes Possible. The coalition’s goal is to help 25,000 Black families buy and preserve their homes in the next 10 years, in order to close the Las Vegas Black homeownership gap. We can’t fix the problem tomorrow but, together, we can meaningfully help thousands of Black families, raise awareness of this issue, and hopefully inspire others to take action for themselves and their families on the path towards homeownership and wealth creation.

So what’s caused this divide in the first place? Let’s look at where the problems began:

A Failed Initiative–Field Order 15

If we go back in history roughly 150 years, the American Civil War was over and Field Order 15 was supposed to go into effect. This was an order created by Union Generals after meeting with twenty Black community leaders to discuss what could best help newly emancipated Black Americans create stable lives. These community leaders told the Union Generals that people needed land in order to provide for themselves.

Field Order 15 set aside hundreds of thousands of acres of land to be settled by Black Americans. Abraham Lincoln signed the order, but just weeks later, President Lincoln was shot and killed. His successor, Andrew Johnson, overturned the order and thousands of people were evicted from their newly settled land.

Redlining

About 60 years after Field Order 15 failed to be implemented, the Federal Housing Administration was created in 1934 as part of FDR’s New Deal. The goal was to make it easier for Americans to get access to funds needed to buy a home and start building some financial security.

This deal could have been great if it weren’t for redlining. About a year after the FHA was created, they created a map of neighborhoods that were considered safe investments. The neighborhoods that were not considered safe investments had big red lines drawn in marker through them on the map. The FHA would not guarantee mortgages in any of the redlined neighborhoods.

The reason this caused a racial homeownership gap is because nearly all the redlined neighborhoods were neighborhoods with a majority of Black residents. It became nearly impossible for people in these neighborhoods to secure a loan. Redlining was a practice that continued preventing Black Americans from becoming homeowners well into the 1960s. It wasn’t until the Fair Housing Act of 1968 that this practice was discontinued.

So where are we now?

It’s been years since redlining and forms of housing discrimination were legal, so the homeownership gap should be shrinking, right? In actuality, the modern gap in homeownership between Black and white U.S. families has reached record highs. In fact, it’s larger today than it was when it was legal to deny someone housing because of the color of their skin. So what’s going on?

Illegal Discrimination

One reason the housing gap has continued to grow is that even when discrimination is illegal, it doesn’t necessarily stop. Senator Cory Booker describes an experience his parents had while trying to buy a house as Black Americans in 1969. During their search for a home, real estate agents would regularly only show homes in predominantly Black neighborhoods. When they visited potential homes in white neighborhoods, they were told the homes were already sold.

Booker’s parents were suspicious of discrimination, so after being told that one home in a white neighborhood was no longer available, they sent a white couple to see the home in their place. The white couple made an offer, it was accepted, and when it came time to close on the home, Booker’s father showed up with a lawyer, instead of the white couple.

The agent was furious when he realized what had happened. The agent begged them not to go through with the home purchase. In fact, at one point a physical fight broke out over the issue. In the end, Cory Booker’s family ended up with the home, and it helped tremendously in forwarding their financial standing.

Unfortunately, not everyone who experiences housing discrimination is able to catch it like Cory Booker’s family. Many Black Americans still experience discrimination throughout the real estate process. Over the years, many people have not become homeowners because of it.

Subprime Loans

The Great Recession was devastating to American homeowners, but the devastation hit especially hard among Black and Brown communities. Many homeowners in these communities purchased their homes with subprime loans. This has been another one of the driving factors in keeping the homeownership gap wide.

Subprime loans have higher interest rates than conventional loans, and they’re typically offered to people with low credit scores. However, a recent study found that Black borrowers were more likely to be given high-cost mortgages during the housing boom that occurred before the 2008 crash. A 2019 study, similarly found that lenders are charging higher interest rates for Black households with financial records similar to those of white households.

When the recession hit, families with higher interest rates and higher payments had greater difficulty keeping up with the bills. Many people lost their homes, setting back their financial progress significantly.

Generational Wealth

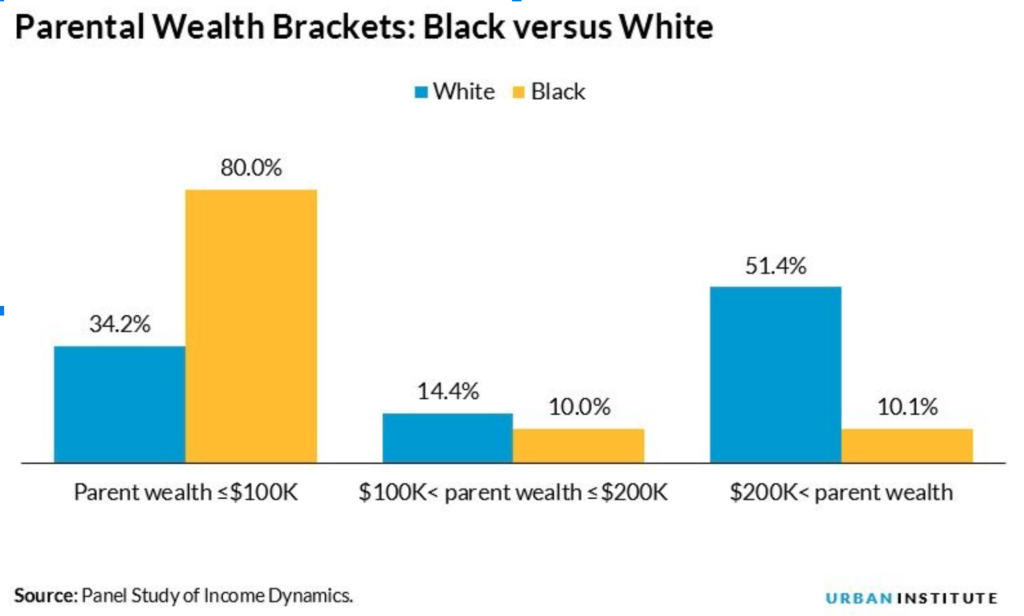

Many of today’s young adults and potential homeowners were raised by parents who were affected by the era of rampant subprime loans and the housing market crash. Those parents were raised by parents who lived while redlining was still in effect. According to the Urban Institute, a full 12% of the homeownership gap comes is caused by discrepancies in generational wealth between the Black and white communities.

The Urban Institute’s research found that young adults whose parents had incomes greater than $200K were significantly more likely to own homes than young adults whose parents had incomes lower than $100K. This causes a huge racial gap because the study showed 51% of white parents have over $200K, while just 10 % of black parents have an income in that range.

The Coalition To Make Homes Possible

With a gap so wide and one that has existed for so long, you may be wondering what can be done to shrink the divide. In the late 1960s, the Kerner Commission’s Report was released and it included multiple recommendations for shrinking the gap. These suggestions included tactics such as creating ownership supplement programs, expanding and reorienting urban renewal programs, and ensuring local HOAs are not participating in discriminatory practices.

Homie is proud to sponsor the Las Vegas Coalition to Make Homes Possible, a collective impact initiative including the Urban Chamber of Commerce, Nevada Housing Division, National Association of Real Estate Brokers to name a few. This effort was founded on the tactics laid out by the Kerner Commission’s Report. The coalition’s goal is to close the Black homeownership gap in Southern Nevada by helping 25,000 Black families buy a home in the next 10 years.

Learn more about this crucial work at MakeHomesPossible.org