You could risk it, but why? Starting October 12th, when you list with Homie, you get six months of seller home warranty protection for free. Even the first $65 service charge is waived.

What is a Seller Home Warranty?

A seller’s warranty covers the seller in the event that something like an appliance breaks or the water heater goes out while a home is on the market. It gives both seller and buyer peace of mind while progressing through the real estate transaction.

Raychel Johnson, from America’s Choice Home Warranty, explains that homes covered by a seller’s warranty increases the perceived value of a home in three ways.

- Sellers with a home warranty are more apt to fix problems ASAP, so prospective buyers may not notice a malfunctioning dishwasher when they look at the house.

- If the buyer or home inspector finds a new problem, it’s fixed quickly with a deductible payment rather than through renegotiations.

- A buyer who knows that a seller’s warranty is covering the home during the listing period feels their future investment is protected from harm. Not only has the home been well maintained in the past, but if something goes wrong between offer and closing, it will be fixed by the warranty.

To sign up for a free seller policy, call 888.495.2249 and tell them you’re with Homie.

How you use your Homie seller’s home warranty

Financially speaking, a seller’s home warranty coverage is a smart move. From the first day you start showing your home, plus the entire time you’re under contract, all the way until possession of the home transfers to a new owner, you’re responsible for keeping everything in prime operating condition—including plumbing, electrical, and appliances.

With the America’s Choice Home Warranty (free to all Homie sellers), all you pay is a $65 service call fee to have covered items repaired—far cheaper than replacing appliances or lowering the sale price. With America’s Choice Home Warranty, you can choose your own professional repair person, which beats telling prospective buyers to ignore the mess in the bathroom while you finish snaking the toilet. And you can even use it to do a tuneup of the heating and/or air conditioning unit. It’s all covered.

One more thing: don’t confuse a home warranty with homeowner’s insurance. While homeowner’s insurance covers major problems such as fires, hail, property crimes and certain types of water damage that could affect the property, a home warranty covers specific components within the home. Your homeowner’s insurance policy will never pay to repair a broken dishwasher.

Adding a buyer’s home warranty

A buyer’s home warranty lets buyers know that if something goes wrong after they move in, they don’t need to come up with the cash to fix it.

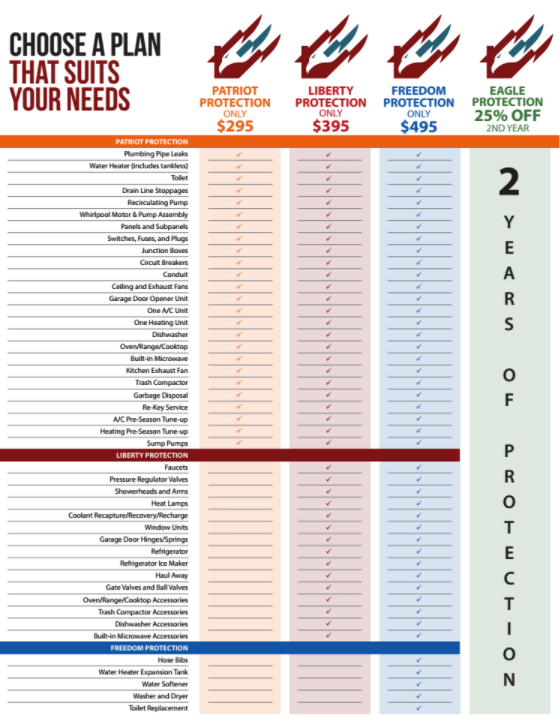

“The buyer’s home warranty protects the buyer after they complete the purchase,” said Johnson. “Many sellers make this investment for the buyer. The low price—between $300 and $500—makes the situation much less stressful for both buyers and sellers.”

The addition of a buyer’s home warranty typically equates to:

- An increase in the final selling price

- Shorter time on market

- A boost in traffic to an older home

That said, Johnson indicates the age of a home shouldn’t determine whether it has a buyer’s home warranty or not. “Even if the appliances are covered under a manufacturer’s warranty, buyers still have a possibility of a pipe leak or something happening to the sump pump or electrical system in a newer home. Or you might just want an AC tune-up,” she said.

Most buyer’s home warranties cover the first 12 months after purchase, although America’s Choice Home Warranty gives Homie buyers (and sellers purchasing for buyers) an optional second year for 25% off, if you purchase the warranty through Homie’s Provider Marketplace.

Protect your home and your sanity. Call 888.495.2249 for your free seller warranty and ask about your options for a buyer’s warranty today.